The voluntary automobile scrapping coverage introduced within the Union Finances for 2021-22 supplies for health check after 20 years for private automobiles whereas business automobiles would require it after the completion of 15 years.

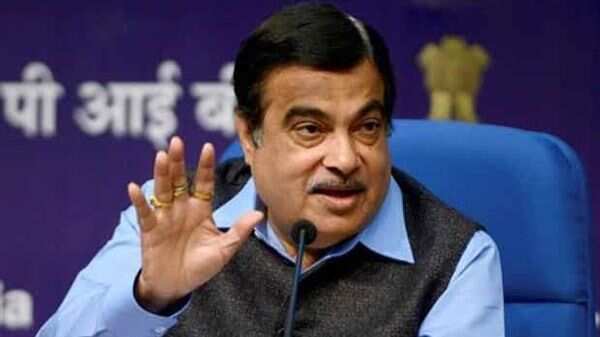

“Car producers will present about 5% rebate on new automobile purchases” to the customers in lieu of scrapping of the previous, Highway Transport, Highways and MSMEs Minister Gakdari informed PTI.

“There are 4 main parts of the coverage…Aside from rebate, there are provisions of inexperienced taxes and different levies on previous polluting automobiles. These will probably be required to endure obligatory health and air pollution checks in automated amenities. For this automated health centres can be required via out within the nation and we’re working in that path,” Gadkari stated.

Automated health checks will probably be arrange beneath public personal partnership (PPP) mode whereas the federal government will help personal companions and state governments for scrapping centres, he stated.

Driving such automobiles that fail to move automated checks will entice enormous penalties and in addition be impounded, the minister stated.

This coverage goes to be a boon for the auto sector, making it some of the worthwhile sectors which in flip would generate enormous employment, the minister stated.

The coverage is touted as a significant step to spice up the Indian car sector, reeling beneath the hostile affect of the COVID-19 pandemic.

The minister stated it might result in a 30 per cent enhance to the Indian car business turnover to ₹10 lakh crore within the years to return from the current about ₹4.5 lakh crore.

Gadkari stated: “Car business turnover which is ₹4.5 lakh crore at current is more likely to swell to ₹10 lakh crore in years to return with India turning into an car hub.”

The export element of this which at current is ₹1.45 lakh crore will go as much as ₹ ₹three lakh crore, he stated and added that after the coverage involves observe availability of scrapped materials like metal, plastic, rubber, aluminium and many others will probably be utilized in manufacturing of car components which in flip will scale back their value by 30-40%.

He stated the coverage will toughen new applied sciences with higher mileage of automobiles apart from selling inexperienced gasoline and electrical energy and reduce on India’s enormous ₹eight lakh crore crude import invoice which is more likely to improve to about ₹18 lakh crore.

“This coverage will lead to improve in automobile demand which in flip would enhance income. Additionally, ancillary industries would come up in massive numbers thriving on junk automobiles,” the minister stated. The minister stated initially about one crore polluting automobiles would go for scrapping.

Of this an estimated 51 lakh will probably be mild motor automobiles (LMVs) which are above 20 years of age and one other 34 lakh LMVs which are above 15 years.

It will additionally cowl 17 lakh medium and heavy motor automobiles, that are above 15 years, and at present with out legitimate health certificates, he stated.

It should toughen ‘Aatmanirbhar Bharat’ marketing campaign, he added.

Itemizing some great benefits of scrapping, the Highway Transport and Highways Ministry had earlier stated that an previous four-seater sedan will lead to a lack of ₹1.eight lakh in 5 years whereas for a heavy automobile it involves ₹eight lakh for a interval of three years.

“Construction and framework of scrapping coverage is beneath work and inexperienced tax has already been notified. Many states have notified in ineffective approach ….We wish to advise the state governments via notification beneath Motor Automobiles Act to think about imposing inexperienced tax on older automobiles which trigger extra air pollution,” Highway Transport and Highways Secretary Giridhar Aramane had stated final month.

Presenting the Finances for 2021-22 in Parliament, Finance Minister Nirmala Sitharaman on February 1 had stated that particulars of the scheme will probably be individually shared by the ministry.

Gadkari had stated the coverage will result in new investments of round ₹10,000 crore and create as many as 50,000 jobs.

These automobiles are estimated to trigger 10-12 occasions extra air pollution than the most recent automobiles.

The federal government had earlier stated it plans to impose inexperienced tax on previous polluting automobiles quickly in a bid to guard the setting and curb air pollution whereas automobiles like sturdy hybrids, electrical automobiles and people operating on alternate fuels like CNG, ethanol and LPG will probably be exempted. The income collected via the inexperienced tax will probably be utilised for tackling air pollution. Below the scheme, transport automobiles older than eight years could possibly be charged inexperienced tax on the time of renewal of health certificates on the fee of 10-25 per cent of highway tax, as per inexperienced tax proposal despatched to states for consultations after cleared by the ministry.

Trade specialists stated the coverage will present a fillip to the Indian authorities’s efforts to place India as a worldwide car manufacturing hub, in addition to profit international automakers with manufacturing industries in India, together with Japanese giants Suzuki, Toyota, Nissan, amongst others.

JobbGuru.com | Discover Job. Get Paid. | JG is the world’s main job portal

with the biggest database of job vacancies globally. Constructed on a Social First

enterprise mannequin, put up your job immediately and have one of the best expertise apply.

How do you safe one of the best expertise for that emptiness you might have in your

organisation? No matter job stage, specialisation or nation, we’ve

acquired you coated. With all the roles vacancies printed globally on JG, it

is the popular platform job seekers go to search for their subsequent problem

and it prices you nothing to publish your vacancies!

Utterly FREE to make use of till you safe a expertise to assist add worth to

your online business. Publish a job immediately!