Op/Ed by Chris Devonshire-Ellis

Hong Kong has remained in unfavourable media once more this yr, with Beijing’s introduction of a new safety regulation on the forefront of a lot publicity and claims of overly oppressive legal guidelines threatening free speech and ‘democracy’. Whereas China has clamped down pretty onerous by way of public dissent, quite a lot of nonsense has additionally unfold the phrase in regards to the demise of Hong Kong and promoted an total concern of China.

I first visited Hong Kong method again in 1968, when as a baby I noticed communist disruptions within the streets for the primary time. By 1988, I used to be visiting repeatedly and by 1992 was dwelling there, as Dezan Shira & Associates opened its first places of work. Since then, I’ve crossed the borders into Hong Kong roughly 600 instances out and in. It’s a metropolis I do know effectively. At this time Dezan Shira & Associates is now dwelling in its fifth workplace location and presently employs about 30 employees within the metropolis.

I hear what the likes of Nathan Regulation need to say, now exiled within the UK and am partially appalled by his personal method – which is more and more all about him as a voice of the individuals. Whereas I agree that he was handled poorly by the authorities, his new standing as a voice for democracy additionally grates as a sort of democracy thumping, self-promoting Kardashian. Additionally it is bizarre; Hong Kong was by no means democratic beneath British rule, and the UK itself just isn’t a full democracy: The Home of Lords oversees Democratic voters, and the Queen can, ought to she select, veto any deliberate new laws. The British Navy pledges allegiance to the Monarch, to not a democratically elected Authorities.

Current (repeated) articles by the likes of Dan Harris, whose more and more “Anti-China Regulation Weblog” spout off phrases equivalent to “Hong Kong as a world enterprise and monetary middle is not any extra”, “Implement plans for evacuating your Hong Kong personnel” and “Keep away from going there except really obligatory” can all be learn in his article “Hong Kong’s Demise and Merry Christmas” via which he seeks to justify his tackle town by stating that his regulation agency (Harris Bricken) “not being so tied to China” is actually the important thing to understanding the problems Hong Kong faces.

Effectively, no less than Harris obtained that half proper. He and his weblog hold forth largely from Seattle whereas Harris has by no means lived in both Hong Kong or China. It’s a distant, armchair opinion, and is a theme China Regulation Weblog continues with one other Harris Bricken lawyer, Fred Rocafort, stating yesterday that “Hong Kong Is Just like the Proverbial Boiled Frog“.

Rocafort implies he left his job in Hong Kong to return to the US “due to Hong Kong’s growing convergence with the Mainland. I needed no a part of that” which makes one marvel if he ever realized Hong Kong was really returned to China 23 years in the past.

That’s OK – ought to China Regulation Weblog not want to be concerned with China then that’s their enterprise and with inherent views like that it’s hardly stunning to see them try to succeed in out to different, non-Asian markets equivalent to Mexico, actively encourage US corporations to depart China, and launch their new Hashish Regulation Weblog (actually!) the place they could have extra success, and I hope they do. There’s little level in utilizing professionals with an lively dislike of the nation they profess to be servicing, and particularly relating to overseas funding. We want China Regulation Weblog good luck with their new non-China ventures, though a bit rebranding is likely to be clever.

Democracy in the meantime was by no means going to be on the playing cards for Hong Kong, and it was by no means promised within the “One Nation Two Programs” coverage both. Requires this to be expanded by the West have backfired; Beijing isn’t going to be pushed round and it has reacted to criticism by successfully curbing the 50 years “One Nation Two Programs” interval into one which has successfully lasted for about 22 years. I feel it stunning it lasted that lengthy. After 1997 Hong Kong was at all times going to be built-in, finally with China. That is what is going on, and it will be each extraordinary and to Hong Kong’s drawback if it weren’t.

Nonetheless, whereas Dezan Shira & Associates proceed to take care of a enterprise and make use of employees in Hong Kong, together with Hong Kong locals, mainland Chinese language, and overseas expatriates, we’re additionally unhappy with the efficiency of the native Hong Kong Authorities. They’ve tousled the introduction of the safety regulation, failed to handle issues inside native housing, training, employment, and associated points, and proceed to run the place as a quasi-fiefdom.

This should cease – vested pursuits between enterprise pursuits and native politicians are far too cozy, and our view, which actually is from on-the-ground, is that Beijing is unwilling to step in however is compelled to take action attributable to native political incompetence and corruption. We too are sad with the scenario Hong Kong finds itself in. However in contrast to others, we want to assist get it via this troublesome section.

There’s a transition occurring and though that is additionally proving overly traumatic via fundamental political mismanagement, additionally it is partially predictable. Any economic system that modifications course goes to really feel burdened, and Hong Kong is not any exception. But there may be gentle on the finish of the tunnel. Hong Kong is being absorbed into the Larger Bay Space, and that is each redeveloping and repositioning it.

Hong Kong’s low, easy and restricted tax, its open capital/foreign exchange market, and proximity to the Larger Bay Space and China are clearly clear benefits that can stay past the inefficient and laissez-faire angle of the prevailing Hong Kong Authorities operating a medium-sized Chinese language metropolis with none clear indication about its future. Past this present interval although, which can go, there are additionally constructive alternatives – and choices.

Hong Kong’s entry to a US$three trillion personal wealth market

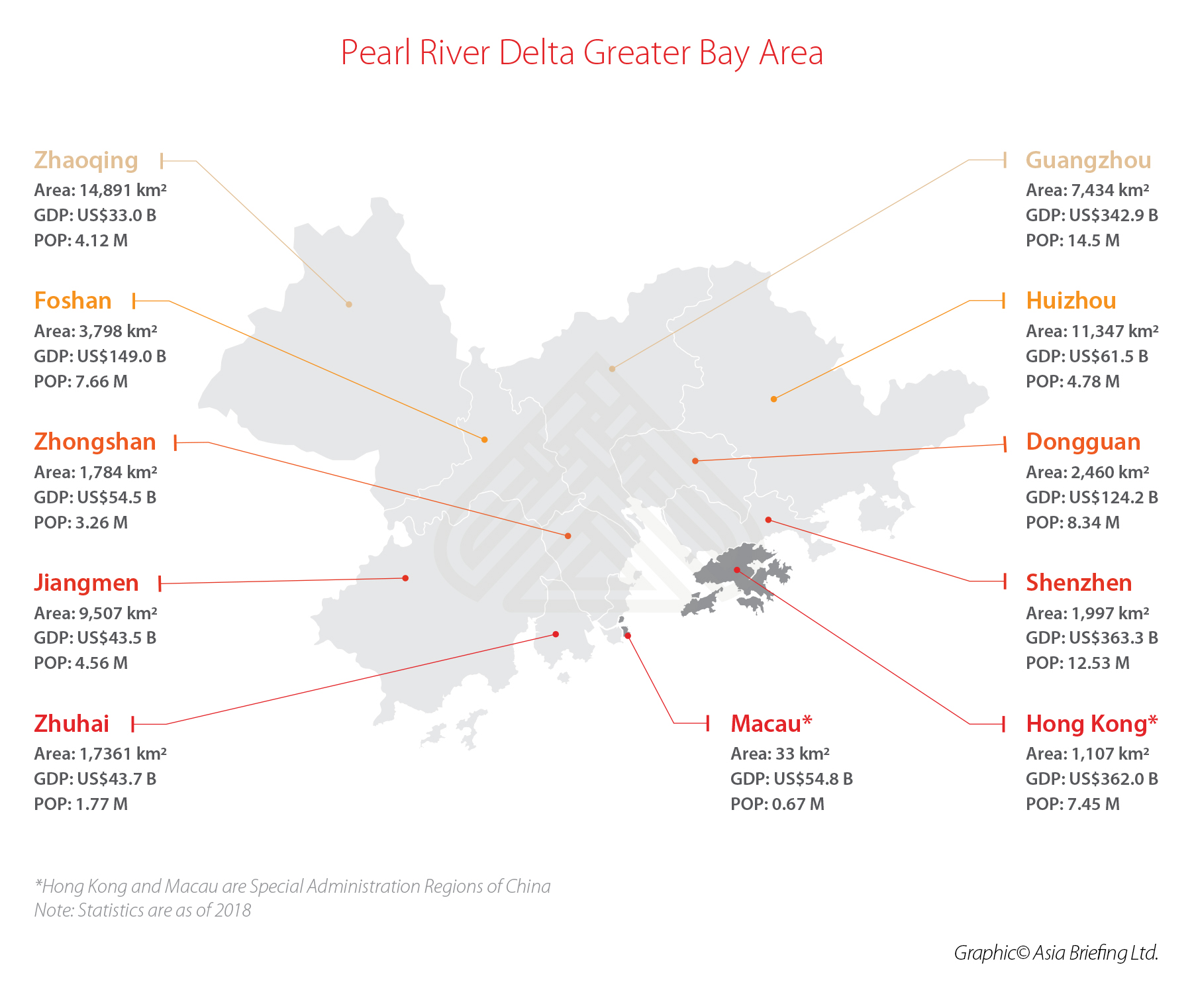

The Larger Bay Space could be the world’s 12th largest economic system if taken as a single bloc, comprising of 11 cities with a mixed inhabitants of 72 million and an economic system value about US$1.7 trillion. It will present loads of alternatives for Hong Kong. On the time of Hong Kong’s handover to China in 1997, it accounted for practically 20 p.c of China’s GDP, however attributable to China’s rise since then, this has shrunk to three p.c at the moment. Regardless of that smaller slice of the pie, China’s progress is now creating alternatives for Hong Kong moderately than vice versa as in 1997. That is the transition I point out and might be additional defined.

Hong Kong is one in every of Asia’s monetary facilities, with free capital motion, a low tax regime and powerful experience in monetary providers (providers are 95 p.c of Hong Kong’s GDP). These will play an essential position relating to tapping into the Larger Bay Space’s large personal and company financial savings, and capital markets.

A transparent benefit for Hong Kong corporations and professionals shall be in monetary providers. This sector has been steadily creating over the previous few years, beginning with the launch of Inventory Join in 2014 to Bond Join in 2017, permitting offshore cash to faucet into China’s rising economic system and bourses. More moderen promulgated rules this yr on Wealth Administration Join present important alternatives for each native, Chinese language and overseas corporations in Hong Kong seeking to entry the US$three trillion of privately held monetary belongings in mainland China (of which over US$1 trillion is within the Larger Bay Space alone). This in flip will present entry to new funding and insurance coverage merchandise, inexperienced finance, and different progressive monetary providers and merchandise.

Aside from wealth administration, there are many alternatives for all times insurance coverage, funds, securities, asset administration, and so forth. Insurance coverage Join may even observe on the successes of the opposite “join” providers talked about, whereas B2B and B2C monetary sector merchandise, inexperienced finance, household places of work, block-chain, and fintech are all creating new incentives to be in Hong Kong and the area.

Larger Bay Space tax regimes are additionally being adjusted. Presently, the Particular person Revenue Tax (IIT) system of mainland China adopts a seven-level progressive fee, starting from three p.c to 45 p.c, which is larger than Hong Kong’s wage tax and private evaluation. Hong Kong has a five-level progressive fee, starting from two p.c to 17 p.c, or a regular fee of 15 p.c.

To decrease the IIT fee and offset the distinction with Hong Kong, 9 mainland Larger Bay Space cities have launched IIT subsidies from 2019 to 2024. Throughout this era, the portion of the IIT that exceeds 15 p.c of the taxable revenue paid of the certified abroad expertise shall be refunded as fiscal subsidies. Small- and medium-sized enterprises’ (SME) Hong Kong might need as an alternative to contemplate the Larger Bay Space choices, the place taxes are comparable however working prices equivalent to lease and common price of dwelling far decrease.

RMB buying and selling & international China help providers

Hong Kong continues to be the world’s largest RMB clearing middle(75 p.c of the overall) and can proceed to take care of its position as an RMB enterprise hub, in flip, becoming in with China’s need to place the RMB as a world forex. The RMB is already the second-most transacted forex via SWIFT, overtaking the euro in use again in 2013. That pattern will proceed and runs parallel to Beijing’s need to internationalize the RMB.

There are important back-office and buyer relationship middle necessities all through the Larger Bay Space which Hong Kong will each fund, and help, whereas Hong Kong’s universities and teachers are already increasing their actions into China.

That mentioned, there are challenges.

Why Hong Kong? What are my choices?

For overseas traders, the primary query is why do it’s worthwhile to be in Hong Kong?

The place and what’s what you are promoting? The place do you maybe have higher alternatives?

The reply is: it relies upon. It relies upon upon the kind of enterprise you’re concerned with, and the place finest to place that. The constructive side is that traders have choices, with Hong Kong being one in every of them. Relatively than crude statements equivalent to “Hong Kong is lifeless, stick a fork in it“ traders focused on China and Asia now have choices.

On this regards, China has been opening up and bettering its enterprise setting, parts of which I described in a reasonably complete article A New China for 2021 the place I talk about the constructive influence of China’s new Overseas Funding Regulation, Destructive Checklist, outbound funding developments and Belt and Highway initiatives all deliver to the desk for overseas traders within the New Yr.

There are options to Hong Kong. Why be based mostly there and never in any of the opposite ten cities of the Larger Bay Space? In monetary phrases, the Larger China inventory exchanges of close by Shenzhen and Shanghai carried out about 40 p.c of all international IPO’s in 2020, whereas Hong Kong’s share of IPOs declined US$6 billion beneath its 2018 peak. That mentioned, it shouldn’t be forgotten that final yr Hong Kong dealt with two of the world’s prime 5 IPOs in Alibaba (US$12.9 billion) and Budweiser (US$5.7 billion). Hong Kong will get well floor as its scenario normalizes, nevertheless it does have severe competitors.

Dezan Shira & Associates have already lengthy responded to the brand new challenges and alternatives of the Larger Bay Space area – we’ve places of work in 5 of the highest ten Larger Bay Space cities: Hong Kong itself, Guangzhou, Shenzhen, Dongguan, and Zhongshan. We acknowledge the have to be built-in into what is going on and to supply regional providers all through the Larger Bay Space – together with Hong Kong. They’re complementary, with Hong Kong’s future position being as a monetary providers hub.

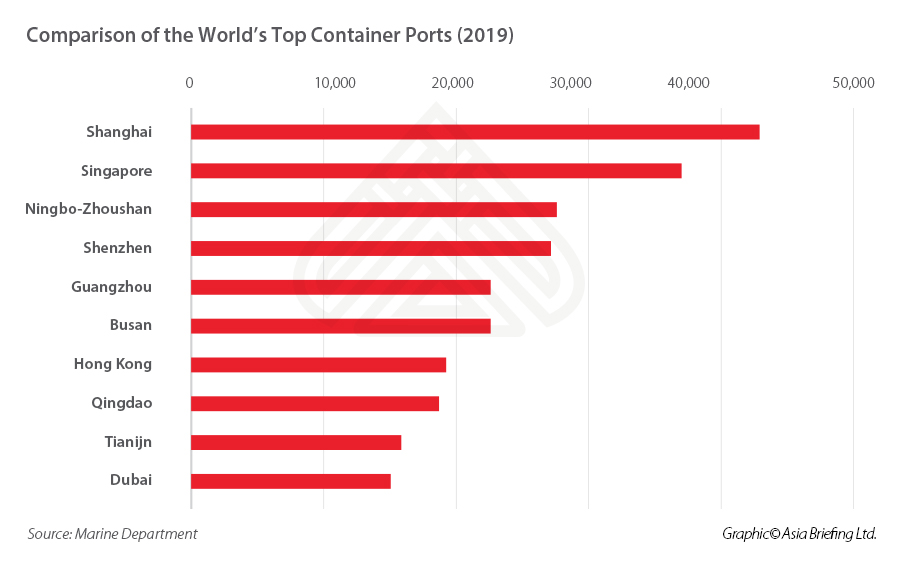

That rising competitors that many counsel indicators a ‘demise’ additionally extends to Hong Kong’s place as a China export Port of selection. In freight phrases, it’s going to quickly be overtaken by Qingdao and Tianjin in international rankings, whereas integration with the Larger Bay Space will imply leveraging different cities (and ports) strengths by way of infrastructure and logistics. Hong Kong’s conventional benefit in transshipment will stop to be a particular benefit.

Hong Kong’s relationship with the USA

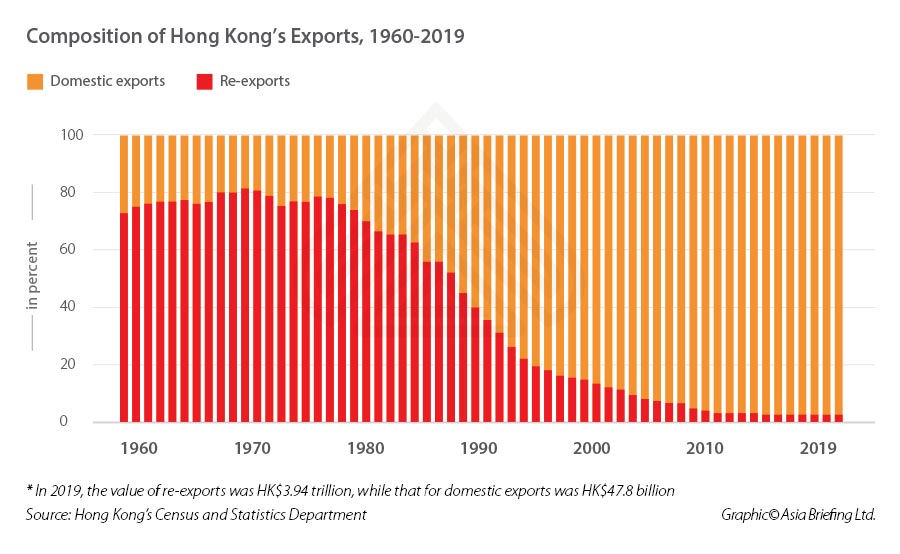

Hong Kong’s buying and selling with the US is basically a re-export middle, albeit a really highly effective one, particularly when contemplating the low or doubtlessly zero company tax for offshore transactions. The territory should think about the price of operations from different international locations equivalent to China itself, Singapore, Port Klang in Malaysia, Thailand’s Laem Chabang, Indonesia’s Tanjung Priok amongst others, and their relationship with the USA and EU. Whereas the US considers Hong Kong-made merchandise ‘Made in China’ and has eliminated its ‘particular standing’ then this impacts on Hong Kong’s competitiveness, and maybe beneath the brand new President Joe Biden the difficulty shall be overcome. However in any occasion, Hong Kong’s rising closeness to the Larger Bay Space overcomes any US commerce downturn negativity.

There are different points to contemplate when assessing Hong Kong:

- The mutual integration of Hong Kong and the Larger Bay Space have to be watertight;

- Questions over allowing the free motion of products, individuals, cash, and knowledge throughout the Larger Bay Space have nonetheless to be labored out.

- Will the Larger Bay Space transfer forward in a coordinated style, or will varied Larger Bay Space metropolis agendas dictate the tempo of growth.

- How one can harmonize varied totally different techniques (authorized, tax, accounting, customs, funds, and visas.

- Hong Kong is the most costly regional metropolis, with the very best price of dwelling;

- Hong Kong’s salaries over the previous a number of years have been stagnating, GDP has trended down since 2018; rendering it much less engaging for high-flyers.

- Hong Kong’s unemployment fee amongst 15 to 25 yr outdated’s is nearly 20 p.c – how can kids and start-ups embrace alternatives throughout the border in China?

- How one can encourage Hong Kong’s youth to go to, interact, and do enterprise in China when there may be anti-China hatred being vehiculated locally?

- An August 2020 survey by the American Chamber of Commerce in Hong Kong, confirmed that 39% of respondents mentioned they’d think about shifting capital, belongings, or enterprise operations out of town sooner or later sooner or later. Is that this nonetheless legitimate?

- Chinese language personal and SOE companies are nonetheless investing in Hong Kong, and have doubled in numbers since 2018, but haven’t made up for the loss in numbers of these leaving from Japan, the UK, and the USA.

- But many nonetheless see Hong Kong as a straightforward hub from the place to handle Asian operations – however at a value – prices make Hong Kong SMEs unfriendly and so they could also be higher off finding elsewhere – equivalent to Shenzhen. (Which is precisely what Dezan Shira & Associates did again in 1992).

The repositioning of Hong Kong subsequently is a piece in progress and plenty of points stay to be solved. That mentioned, it stays an ideal place to entry mainland China, creating and supporting the monetary providers trade on the mainland and serving to new wealth make investments, each at residence and overseas. Our Hong Kong workplace is recruiting further new employees in 2021. Selling worldwide funds and elevating capital shall be a serious operate of the brand new Hong Kong.

We even have an workplace in Singapore and have been actively facilitating purchasers with extra of an Asian moderately than purely China focus to relocate there. The relocation of holding corporations is nothing new, I recall the Offshore Firm growth years again when individuals arrange companies as an alternative of within the BVI, Cayman Islands, and different comparable jurisdictions. Singapore is an element complimentary, half aggressive to Hong Kong. However to entry China, Hong Kong stays the highest canine.

Our Hong Kong enterprise will increase and proceed to prosper as a result of Hong Kong is being repositioned as a monetary service, a quasi-offshore hub for the US$three trillion held in personal fingers in China. That’s along with the IPO’s, banking, and different providers town supplies. There are teething issues, however these are identifiable and shall be solved over time.

Beijing will get it proper. Naysayers will decry the message anyway, however for these of us dwelling and dealing within the metropolis, modifications are coming, and these will, over the approaching 5 years be more and more constructive. At Dezan Shira & Associates, we’re investing in that future and can proceed to advise traders on the advantages of and options to investing in Hong Kong. That, moderately than continuous Hong Kong and China-bashing, is the extra reasonable, and cheap strategy. There are alternatives, and alternatives in Hong Kong, and we advise traders to contemplate each.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The follow assists overseas traders into China and has finished so since 1992 via places of work in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at [email protected]. We additionally keep places of work helping overseas traders in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, along with our practices in India and Russia and our commerce analysis services alongside the Belt & Highway Initiative.

JobbGuru.com | Discover Job. Get Paid. | JG is the world’s main job portal

with the biggest database of job vacancies globally. Constructed on a Social First

enterprise mannequin, publish your job at the moment and have the very best expertise apply.

How do you safe the very best expertise for that emptiness you might have in your

organisation? No matter job degree, specialisation or nation, we’ve

obtained you coated. With all the roles vacancies revealed globally on JG, it

is the popular platform job seekers go to search for their subsequent problem

and it prices you nothing to publish your vacancies!

Utterly FREE to make use of till you safe a expertise to assist add worth to

what you are promoting. Submit a job at the moment!