The financial relationship between India and ASEAN started in 1992 as each areas acknowledged one another’s commerce capabilities. The connection has since strengthened with India’s rising manufacturing capability and the rise of ASEAN’s providers sector exports, particularly journey, transport, and enterprise providers.

The 2 areas share similarities of their ranges of financial improvement; they’re residence to quickly increasing markets and intention to deal with infrastructure challenges. These similarities supply house for continued and extra diversified commerce in items and providers in addition to business-to-business engagement between India and ASEAN – tapping into the funding necessities of modernizing industries and home consumption traits in one another’s markets.

Financial engagement by way of the free motion of products, providers, and capital, thus, presents mutual advantages for India and ASEAN. This was the rationale that propelled the signing of the ASEAN-India Free Commerce Settlement (AIFTA) in 2009. The commerce treaty has undoubtedly boosted bilateral commerce.

In keeping with a November 2019 report by the Ph.D. Chamber of Commerce and Business, India’s merchandise exports to ASEAN elevated from US$23 billion in 2010 to US$36 billion in 2018 at a compound annual development price (CAGR) of about 5 %, whereas its merchandise imports from the 10-member bloc elevated from US$30 billion in 2010 to US$57 billion in 2018, at a CAGR of about eight %. India’s exports to ASEAN in 2019-20 have been price US$31.49 billion whereas its imports from the bloc reached US$55.37 billion.

In its commerce with ASEAN, India has moved to get rid of tariffs on as much as 75 % of 12,000 tariff strains. A report from the Nationwide Establishment for Reworking India (NITI Aayog) discovered that this had led to the commerce steadiness worsening in 13 out of 21 sectors, together with textiles, leather-based, and minerals. India’s commerce deficit with ASEAN international locations is at the moment round US$24 billion and is why New Delhi stays eager to renegotiate the phrases of the ASEAN-India FTA to make sure a extra degree taking part in area for Indian exports to ASEAN.

On this article, we break down key export-oriented industries that provide most worth by way of catering to ASEAN’s market wants, commerce benefits obtainable to India within the ASEAN area, and at last funding alternatives in India for ASEAN-based companies.

India’s prime export-oriented industries

In 2019, 47.Eight % of India’s exports by worth have been delivered to fellow Asian international locations; 19.Three % have been offered to European importers and 18.Eight % price of products have been shipped to North America.

Amongst India’s prime 15 buying and selling companions in 2019, Singapore got here in fifth (US$10.7 billion or 3.Three %), Malaysia twelfth (US$6.14 billion or 1.9 %), and Vietnam fourteenth (US$5.49 billion or 1.7 %). That 12 months, India’s prime 10 exported items accounted for three-fifths (60.2 %) of the general worth of its world shipments.

- Mineral fuels together with oil: US$44.1 billion (13.7 % of whole exports)

- Gems and treasured metals: US$36.7 billion (11.Four % of whole exports)

- Equipment together with computer systems: US$21.2 billion (6.6 % of whole exports)

- Natural chemical compounds: US$18.Three billion (5.7 % of whole exports)

- Automobiles: US$17.2 billion (5.Three % of whole exports)

- Prescribed drugs: US$16.1 billion (5 % of whole exports)

- Electrical equipment and tools: US$14.7 billion (4.5 % of whole exports)

- Iron and metal: US$9.7 billion (Three % of whole exports)

- Clothes and niknaks (not knitted or crocheted): US$8.6 billion (2.7 % of whole exports)

- Knitted or crocheted clothes and accessories: US$7.9 billion (2.5 % of whole exports)

Subsequent, we briefly highlight three industries – the jewellery, pharmaceutical, and agricultural industries – whose exports characteristic within the prime 10 for India.

Gems and jewellery trade

India’s gems and jewellery trade contributes about seven % to the nation’s GDP and 15 % to its whole merchandise export. India has permitted 100 % overseas direct funding (FDI) within the sector below the automated route. Cumulative FDI inflows in diamond and gold ornaments was round US$1.18 billion between April 2000 and September 2020. The trade employs greater than 4.64 million folks, which is anticipated to close double by 2022. India’s gems and jewellery market dimension is projected to develop by US$103.06 billion between 2019 and 2023.

The sector is labor intensive and export-oriented. For instance, in line with the Gem and Jewelry Export Promotion Council (GJEPC), India exports 75 % of the world’s polished diamonds. Regardless of the pandemic, within the interval between April and October 2020, exports of gems and jewellery was US$11.62 billion. In the identical interval, India’s export of minimize and polished diamonds was price US$18.66 billion, which contributed 52.Four % to the full gems and jewellery export. In the meantime, India’s import of gems and jewellery stood at US$24.41 billion in FY20. In FY21 (until September 2020), imports amounted to US$4.23 billion.

General, the Indian gems and jewellery trade is likely one of the world’s largest, supplying 29 % of the worldwide consumption of jewellery. It’s particularly valued as a result of conventional manner Indian jewelers minimize and polish diamonds; in addition they incorporate trendy strategies that don’t have an effect on the standard craft. Obligatory hallmarking within the trade is one other issue contributing to its development and repute.

The scale of India’s home market can also be enormous. India is the second largest client of gold, the demand for which was round 690.Four tons in 2019.

Prescribed drugs trade

The Indian prescribed drugs trade has established itself as a globally aggressive manufacturing and analysis hub, supported by the supply of uncooked supplies and a big workforce. The trade is the world’s third largest by way of the amount of medicines it produces and the 13th largest by way of worth. The Indian pharmaceutical trade was anticipated to develop at a compound annual development price (CAGR) of 22.Four % to succeed in US$55 billion in 2020.

The Indian prescribed drugs market is dominated by generic medication that represent practically 70 % of the market, whereas over-the-counter (OTC) medicines and patented medication make as much as 21 % and 9 %, respectively. India plans to ascertain a fund (price about US$1.Three billion) to spice up firms’ capability to fabricate pharmaceutical substances domestically by 2023. India’s whole medication and prescribed drugs export between April 2020 to November 2020 was US$15.87 billion and for the month of November 2020 – it was US$1.99 billion, in line with information printed by IBEF.

Even after the COVID-19 pandemic, India’s pharmaceutical sector has continued to be a dependable provider of obligatory medication and now, vaccine doses, and is forecast to succeed in a dimension of about US$130 billion by 2030. FDI inflows to the pharmaceutical sector reached INR 36.5 billion (US$501.99 million) in 2019-20, displaying a development of 98 % year-on-year.

Agriculture and meals processing trade

The Indian meals market is the sixth largest on this planet. It contributes 32 % to the worldwide market attributable to its management within the manufacturing and export of meals merchandise. Yearly, India’s export contribution will increase.

In 2018-19, the general export worth of:

- Agriculture and allied merchandise stood at US$18.7 billion

- Basmati rice stood at US$4.71 billion

- Non-basmati rice stood at US$3.03 billion

- Spices at US$3.32 billion

- Processed greens and fruits at US$1.6 billion

- Tea and low at US$1.65 billion

India is the world’s largest processor, producer, client, and exporter of cashew nuts, spices, meals grains, fruits, and greens. On November 11, the federal government introduced that its production-linked incentive scheme would profit meals merchandise, with an outlay price INR 109 billion (US$14.59 billion), earmarked for a five-year interval. Particular product strains displaying excessive development potential and capable of generate medium- to large-scale employment will probably be supported below this scheme. The product strains are: able to eat (RTE) and able to prepare dinner (RTC), marine merchandise, vegatables and fruits, honey, desi ghee, mozzarella cheese, natural eggs, and poultry meat. The processed meals market is anticipated to develop to US$543 billion by the top of 2020. Presently, the trade employs 1.85 million folks and places out an combination output price US$158.69 billion. There’s ample scope for doing enterprise on this house between India and ASEAN – commerce in meals merchandise, meals processing tools, investing in processing industries, tapping into regional small and medium enterprises (SMEs) and creating provide chains and many others.

One space that has usually been missed is the halal meals trade. A 2018/19 report estimated that the Muslim spend on meals and drinks would develop at 6.1 % to succeed in US$1.9 trillion by 2023. India has the world’s third largest Muslim inhabitants however Southeast Asian exporters, similar to Malaysia, dominate the world halal meals market. In October 2019, Indonesia’s Halal Product Legislation got here into impact and plenty of client merchandise and associated providers which can be traded within the nation should now be halal-certified; some services may have till 2022 to conform. India can properly faucet into this fast-growing market – connecting rising indigenous manufacturing capability with its present networks within the ASEAN area. At US$1.7 billion, India was the fourth largest exporter of meals, dominated by meat exports, to Muslim-majority international locations in 2018, in line with the State of the World Islamic Economic system 2019/20 report from DinarStandard. Presently, the halal meals ecosystem is dominated by small and medium enterprises in ASEAN, however world MNCs like Swiss big Nestle, South Korea’s Samyang Meals, and Thailand’s CP Meals are coming into this house.

Benefits of the ASEAN financial system

In a report printed by the Exim Financial institution of India in January 2018, commemorating 25 years of India’s partnership with ASEAN, it was discovered that India’s export choices are extremely diversified given its huge uncooked materials base, massive labor market, and an growing variety of manufacturing hubs. ASEAN masking the Southeast Asian area, then again, has its personal market attraction – with its inhabitants of enormous youth cohorts, rising disposable incomes, and fast-expanding digital economies.

- The 10 member international locations (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam) of ASEAN have a mixed inhabitants of greater than 600 million folks, making it the third largest labor power on this planet. Widespread labor participation has seen the fast development of the manufacturing, retail, transportation, and telecommunications sectors.

- ASEAN is a various grouping of nations whose socioeconomic variations supply overseas traders with a variety of alternatives to spend money on native and ranging markets, relying on their capability. Indonesia represents virtually 40 % of the area’s whole financial output, Myanmar’s native market is a lead attraction for exporters, and Singapore’s GDP per capita surpasses that of the extra mature and older economies of Canada and US.

- ASEAN is a rising client market, anticipated to turn out to be residence to 125 households by 2025.

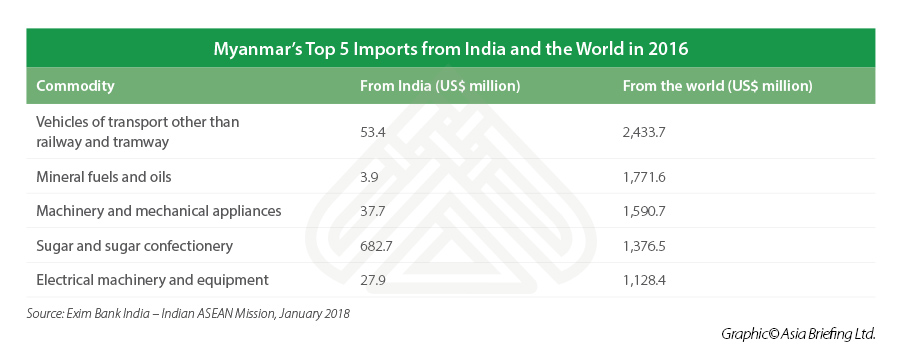

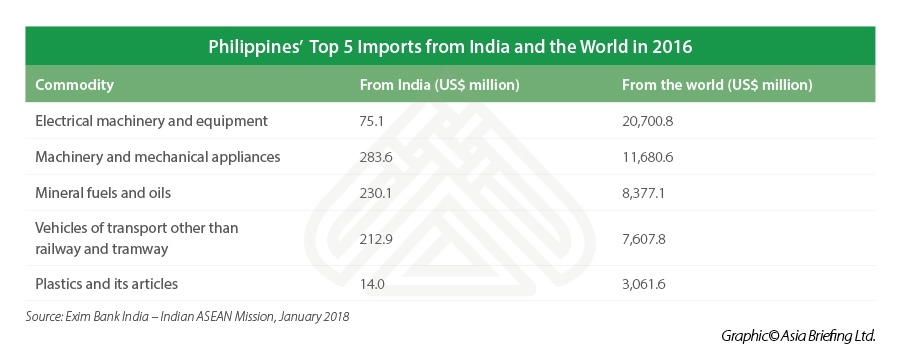

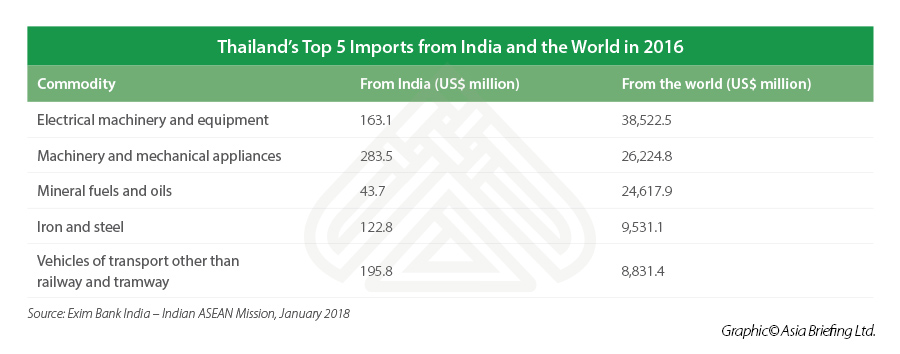

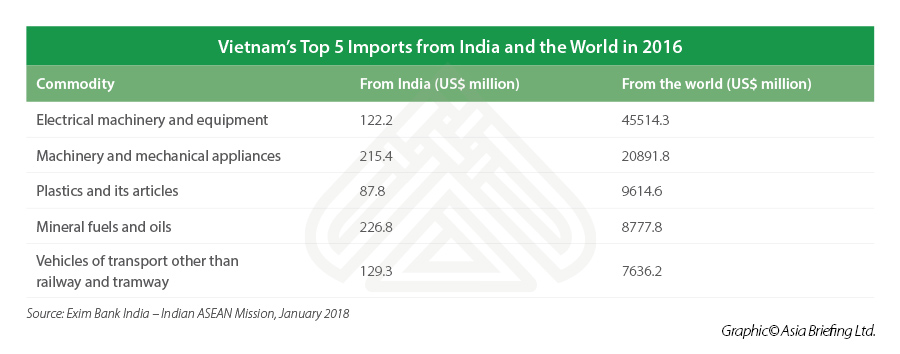

- In 2016, electrical equipment and tools was ASEAN’s greatest import – an trade that India is actively working to broaden by manufacturing capability, tax incentives, and FDI relaxations.

- ASEAN is the fourth largest exporting financial system on this planet, that contributes seven % to the full worth of worldwide exports.

– Vietnamese export of textiles and attire stood at US$36.16 billion in 2018

– Malaysia and Singapore took the lead in exporting electronics price US$373 billion in 2019 and US$9.52 billion, respectively, in October 2020

– Thailand’s automotive sector exported items price US$38.39 million in 2018

– Indonesia is the lead in palm oil and coal exports whose mixed worth stood at US$27 million in 2018 - Myanmar is specializing in cultivating its pure assets of oil, gasoline, and treasured minerals.

- Philippines is popping its consideration in the direction of business-focused providers.

Efficiency of the ASEAN-India Free Commerce Settlement (AIFTA)

India and ASEAN agreed to the AIFTA as a chance to extend their financial interactions by freely buying and selling items with each other within the Asia-Pacific area. The settlement formally got here into impact January 1, 2010. Since then, each areas have made efforts to make commerce between them as easy as potential. Beneath the FTA, India and ASEAN agreed to progressively get rid of tariffs on 80 % of the tariff strains, accounting for 75 % of the commerce. India has excluded 489 tariff strains (HS-06 Digit degree) from the record of tariff concessions and 590 tariff strains from the record of tariff elimination to deal with sensitivities in agriculture, textiles, auto, chemical compounds, petrochemicals, crude and refined palm oil, espresso, tea, pepper, and many others.

Advantages for exporters

ASEAN’s determination to decrease intra-regional tariffs by the Frequent Efficient Preferential Tariff (CEPT) Scheme on exports below the FTA has benefited Indian exporters within the following methods:

- Free motion of Indian items all through the 10 ASEAN international locations.

- Elimination of tariffs on Indian items make them aggressive within the ASEAN market, making them extra accessible.

- Indian uncooked materials exports extra aggressive attributable to decreased tariffs and profit ASEAN producers.

- Indian export complementarities are greater with ASEAN international locations than another area attributable to their shared land and maritime boundaries.

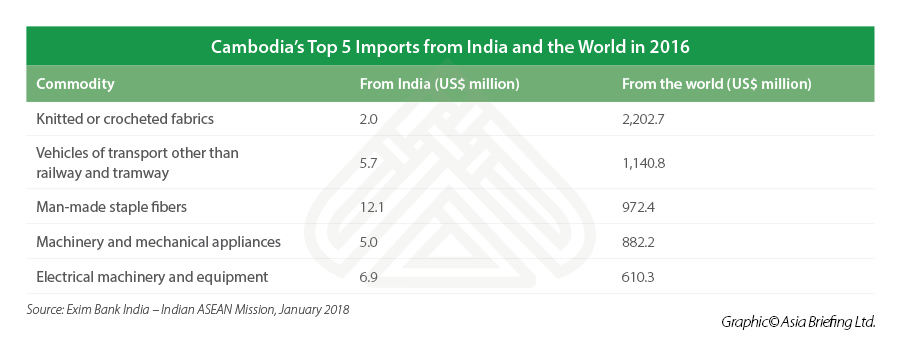

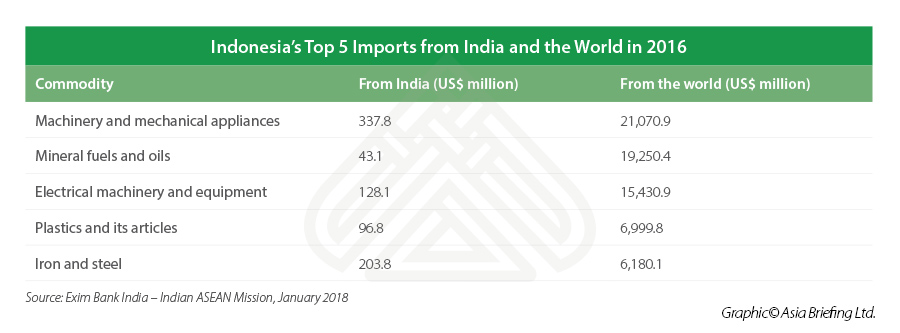

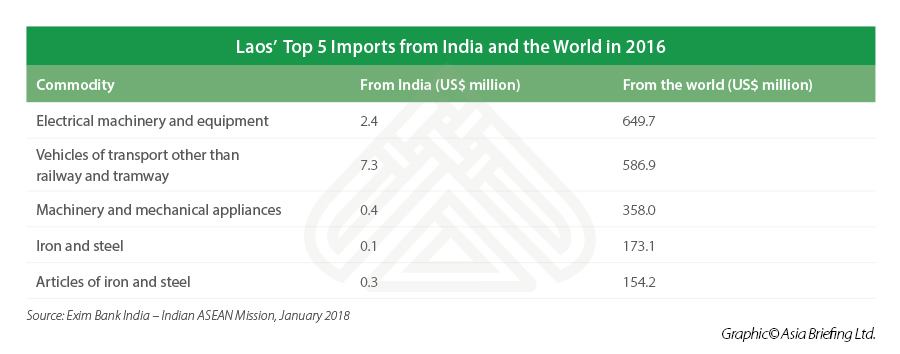

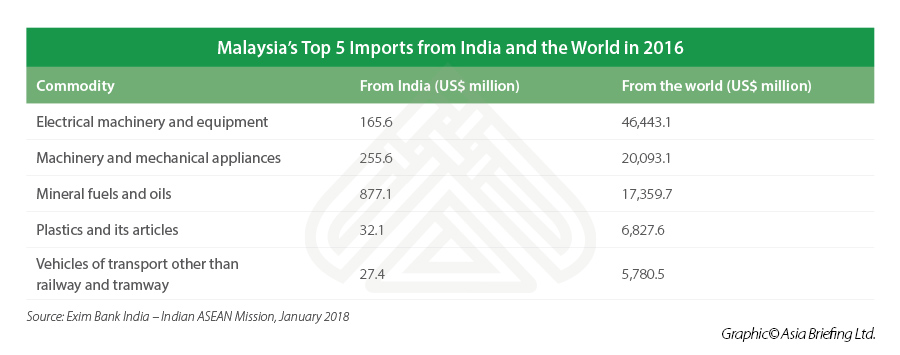

ASEAN prime imports from India and the World (2016)

ASEAN-India Commerce in Companies and Funding Settlement

In 2015, the ASEAN-India Commerce in Companies and Funding Settlement got here into power. Key provisions within the Companies Settlement deal with transparency, home laws, recognition, market entry, nationwide remedy, joint committee on providers, evaluate, dispute settlement and denial of advantages, amongst others. The Funding Settlement focuses on the safety of funding to make sure truthful and equitable remedy for traders, non-discriminatory remedy in expropriation or nationalization, and truthful compensation. The FTA in providers and funding may probably increase Indian-ASEAN commerce to greater than US$100 billion. The Settlement additionally facilitate the motion of Indian service professionals in ASEAN international locations.

Rising alternatives for commerce and funding

Industrial restructuring by regional worth chains

ASEAN is acknowledged as a number one participant within the world worth chain, with robust manufacturing networks established throughout its member international locations. Nevertheless, the regional worth chains of Cambodia, Laos, Myanmar, and Vietnam (CLMV international locations) lag behind and wish capital and know-how to come back at par with different ASEAN international locations.

India can take part of their progress by investments in constructing native industrial capability, creating manufacturing linkages between Indian operations and Southeast Asian suppliers, offering coaching, and opening its personal market entry in restricted segments. The result could be creating regional worth chains at totally different phases of business manufacturing, and linked to providers, that might facilitate the relocation of manufacturing bases throughout India and ASEAN seamlessly.

Furthermore, SMEs type the spine of the CLMV area. Accounting for 90 % of the full enterprises in these economies, they’re the most important contributors to financial output. India can supply its experience in creating SME clusters primarily based on ability and useful resource endowments, institutional strengthening, and export improvement and export functionality creation. India’s personal expertise may present insights for companion international locations within the area and facilitate their internationalization efforts.

Geographical connectivity and infrastructure linkages

The continued Kaladan Multi-Modal Transit is in its last phases in line with remarks made by the Exterior Affairs Minister S. Jaishankar on Monday. The 1,360 km India-Myanmar-Thailand Trilateral Freeway can also be underway, with plans to broaden it to Vietnam by way of Laos. These initiatives should keep on the right track and be fast-tracked to capitalize on the proximity between northeast India and Southeast Asia. As soon as the mandatory transit linkages are constructed, commerce and enterprise can flourish by enhanced market entry, elevated potential for tourism and tradition industries, house to mobilize FDI, and organising export-oriented manufacturing bases in particular financial zones.

Key development areas

E-commerce

India’s e-commerce sector is on an upward development trajectory, projected to be the second largest e-commerce market on this planet by 2034. By 2024, the sector will probably be price US$99 billion with groceries and attire serving as key drivers. The Indian authorities permits 100 % FDI for B2B e-commerce and 100 % FDI below the automated route for {the marketplace} e-commerce mannequin.

Different development drivers:

- Rising disposable incomes and growing web entry in tier 2 cities. E-commerce firms reported gross sales price US$4.1 billion throughout platforms within the festive week of October 2020, pushed by the elevated demand for smartphones. Tier 2 cities like Dhanbad (Jharkhand), Ludhiana (Punjab), Asansol (West Bengal), and Rajkot (Gujarat) contributed 55 % to the e-commerce gross sales.

- Position performed by start-ups and technology-driven improvements facilitating digital funds, hyper-local logistics, digital commercials, and analytics-driven buyer engagement. This, in flip, is anticipated to extend export revenues and create higher services within the long-term.

Training

The scale of India’s e-learning phase is just second to that of the USA throughout the schooling sector. E-learning platforms present schooling and coaching to a inhabitants of 500 million that fall throughout the age bracket of 5-24 years. Between April 2000 and September 2020, India’s schooling sector has acquired FDI price US$3.849 billion, in line with the Division for Promotion of Business and Inner Commerce (DPIIT).

India permits 100 % FDI below the automated route in schooling, and desires globally aggressive establishments for greater studying as per the Larger Academic and Overseas Academic Establishments Invoice. India’s extremely diversified and scalable market ought to encourage ASEAN schooling traders.

In December 2020, India launched the next packages to spice up employment alternatives for its residents:

- Gamma Expertise Automation Coaching, which is a novel career-launching program on robotics for engineers.

- SAKSHAM, which is an initiative by Hyundai Motor India to spice up employment in numerous sectors.

- IGnITE, which is a high-quality technical schooling coaching program to arrange technicians for the trade initiated by Siemens, the Federal Ministry of Financial Cooperation and Growth (BMZ), and the Ministry of Ability Growth and Entrepreneurship. By 2024, this program goals to upskill 4,000 workers.

- India Empowerment Fund, launched by the IIT Alumni Council, to develop a stronger analysis ecosystem. The intention is to achieve investments on this fund price US$6.80 billion within the subsequent 10 years.

Fintech

India is among the many quickest rising fintech markets on this planet, whose total worth is anticipated to develop at a CAGR of 20 % by 2023. In keeping with a Could 2020 report, as of March 2020, India and China accounted for the very best fintech adoption price (87 %) out of all world rising markets. Alternatively, the world’s common adoption price was round 64 %.

The general transaction worth within the Indian fintech market is projected to develop from roughly US$65 billion in 2019 to US$140 billion in 2023. India overtook China as Asia’s prime fintech funding goal market with investments of round US$286 million throughout 29 offers, as in comparison with China’s US$192.1 million throughout 29 offers in Q1 2019.

Progress drivers embrace widespread id formalization (Aadhaar), excessive degree of banking penetration, excessive smartphone penetration, and rising disposable revenue.

In the meantime, findings from the ASEAN Fintech Ecosystem Report Benchmarking Research 2019 confirmed that:

- ASEAN’s massive inhabitants has little entry to monetary services

- Breaches in cyber-security are thought of excessive dangers

- Lack of a very good digital infrastructure

- Lack of balancing market stimulation and threat administration

- Underdevelopment of regulatory harmonization

Healthcare

Healthcare is quick turning into an space of precedence for ASEAN. The World Well being Group (WHO) estimates that ASEAN’s common whole expenditure per capita on healthcare is US$544. With an increase within the total getting older inhabitants of Singapore and Philippines, Singapore’s Healthcare 2020 Masterplan has referred to as for the recruit of greater than 20,000 healthcare employees and the addition of three,700 hospital beds. In Philippines, public personal sector partnerships (PPPs) are starting to achieve momentum. Particularly, the federal government can also be planning the development of a particular tertiary challenge, anticipated to be price US$135 million.

To broaden medical commerce to assist these initiatives, ASEAN firms are being inspired to take part within the India-ASEAN Healthcare Expo to be held just about between February 22-24, 2021 in order that India is ready to improve its investments in ASEAN. Apart from this, the aim of the commerce truthful is to allow ASEAN firms, particularly from Malaysia, to discover enterprise prospects with India in an effort to safe stronger financial and industrial partnerships within the healthcare, medical gadgets, and prescribed drugs sectors.

India with its massive healthcare market, estimated to be price round US$200 billion at the moment, is enthusiastic about connecting its prime stakeholders, enterprise leaders, and senior authorities officers with these of ASEAN, particularly by the use of B2B conferences. Whereas that is additionally pushed by the instant and mutual aim of combatting the COVID-19 pandemic, over the long-term, such engagement is essential to growing cooperation within the medical and medical-related sectors.

Tourism

The ASEAN area is a prime vacationer vacation spot accounting for round 38 % of all vacationer travels. In 2011, the variety of Indian vacationers to ASEAN was 2.71 million. In 2019, the variety of vacationer arrivals from India rose to five.32 million.

India can develop its outbound tourism providers by tapping into ASEAN’s tourism sector potential. Particularly, 5 of ASEAN’s member international locations intention to spice up tourism and entice potential traders by enterprise the next initiatives:

- Indonesia – will embark on a number of infrastructure initiatives to make it an simply accessible nation by increasing the Bali Airport and the Soekarno Hatta Worldwide Airport, Jakarta.

- Malaysia – will intention to extend its variety of vacationers since its document of 25 million in 2011.

- Philippines – will intention to extend actions of leisure and gaming.

- Singapore – will intention to obtain investments with a purpose to set up theme parks and resort casinos.

- Thailand – will intention to raised connectivity with its neighboring international locations within the Mekong area and entice the eye of vacationers by bettering the two,000 km R3A Freeway that runs from Kunming in China by Laos to Thailand.

About Us

India Briefing is produced by Dezan Shira & Associates. The agency assists overseas traders all through Asia from workplaces internationally, together with in Delhi and Mumbai. Readers could write to [email protected] for enterprise assist in India.

JobbGuru.com | Discover Job. Get Paid. | JG is the world’s main job portal

with the most important database of job vacancies globally. Constructed on a Social First

enterprise mannequin, put up your job at present and have the perfect expertise apply.

How do you safe the perfect expertise for that emptiness you’ve gotten in your

organisation? No matter job degree, specialisation or nation, we’ve

acquired you coated. With all the roles vacancies printed globally on JG, it

is the popular platform job seekers go to search for their subsequent problem

and it prices you nothing to publish your vacancies!

Utterly FREE to make use of till you safe a expertise to assist add worth to

your enterprise. Submit a job at present!