Incomes cash is just not simple, however managing your funds is one other ball sport altogether. However what’s vital is to have a finances so it is possible for you to to obviously see the place your cash goes, handle your bills and plan for big expenditures.

There are many budgeting strategies on the market – from the Japanese Kakeibo methodology for protecting family accounts, to Elizabeth Warren’s elegant 50/20/30 Rule, and even the multi-faceted Envelope Budgeting system – every with their very own strengths and quirks.

Discovering one which fits you is just a matter of trial and error.

Irrespective of which budgeting system you select, budgets do require some effort in your half. On the very least, you’ll must report your bills and make some calculations.

However wait. You don’t truly should preserve a ledger to scribble in, grunting all of the whereas (except that’s completely your factor). As a substitute, strive utilizing a budgeting app or two.

That will help you get began, we’ve picked out eight of our favourites.

1. Wally

Wally is chock filled with helpful options, akin to the flexibility to sync your financial institution accounts, or the creation of customised budgets to trace your spending mechanically. It’s simple to see why Wally stands among the many hottest private finance budgeting apps on the market.

The app supplies loads of details about your funds, all damaged down into easy-to-digest sections offered via a clear and easy interface.

Coming into and monitoring your bills is stored simple with its built-in receipt-scanning function, which doubles up as a handy repository for vital payments.

You may as well create buying lists that can assist you keep on with your finances and keep away from impulse buys.

Wally is free to obtain and use. There’s additionally Wally Gold, a paid model that comes with additional options like filtered knowledge exporting and repeat notifications.

Value: FREE

Obtain: iOS

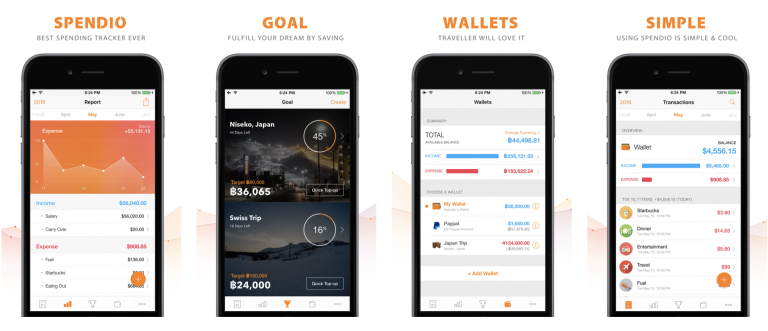

2. Spendio

Developed by Thai app builders Muze Innovation, Spendio is a simplified finances tracker that encourages you to avoid wasting in the direction of your private objectives.

The app makes nice use of an easy-to-read line chart that tracks your bills as they go up and down over time – creating your very personal ‘inventory market’ report, colored in arresting orange.

Saving up for one thing is straightforward; simply create a finances for it and high up anytime in the direction of your objective. You may as well create a separate pockets for journey within the foreign money of your selecting.

All these are superbly designed options that ought to present that additional motivation to rein in your spending in favour of your financial savings objectives. However maybe the good function but is the app’s skill to pair together with your Apple Watch, unlocking the flexibility to enter monetary knowledge through good voice-to-text.

Value: FREE

Obtain: iOS

3. Spendee

A full-featured finances monitoring app, Spendee works like a cash supervisor that lives in your cell. Begin by getting into your bills and property, and the app will consolidate all the things into an easy-to-understand graphic with highly effective insights at a look.

Then, positive tune your funds by setting good budgets that show you how to keep away from overspending, whereas encouraging you to avoid wasting in the direction of future objectives.

The essential app is free to make use of, however you’ll be able to decide in to free trials of deliberate paid options, akin to checking account syncing and crypto pockets linking.

Value: FREE

Obtain: iOS, Android

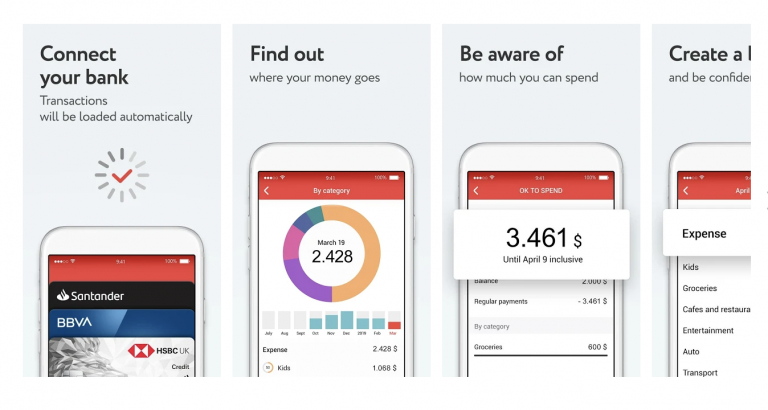

4. Pockets by BudgetBakers

Pockets is one other feature-rich finance monitoring and budgeting app designed to offer a excessive diploma of visibility to your day by day transactions, which ought to show helpful for individuals who typically find yourself shocked by how a lot you’ve spent on artisanal butter this month.

The app comes full with a classy ‘Money Move Development’ chart, which helps you to affirm your funds with a fast look – and hopefully nudge you away from wrecking your finances this month. Different helpful options embody adjustable spending classes and budgets for various bills.

Syncing your financial institution accounts for automated updates (together with different superior stuff like a number of accounts and in-depth experiences) would require a premium subscription, however the free model works properly sufficient so long as you’re devoted with recording your funds.

Value: FREE

Obtain: iOS, Android

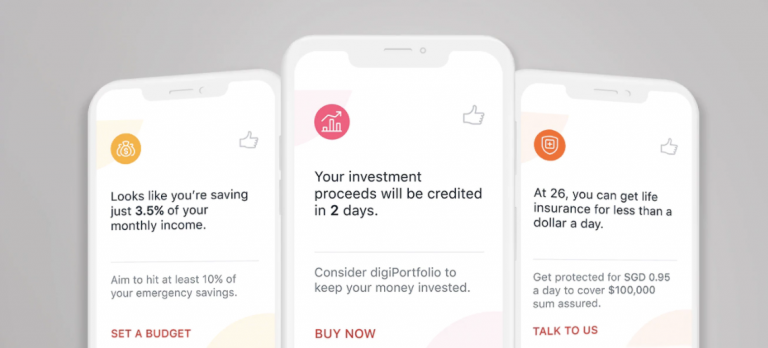

5. DBS NAV Planner

In the event you’re a DBS or POSB account holder, you would possibly wanna discover your digibank app. Hidden within the ‘Plan’ tab is an entire slew of non-public budgeting options on par with a few of the main budgeting apps on the market.

Formally referred to as the NAV Planner, you should utilize this highly effective digital software to trace your cash and develop your property in the direction of future objectives.

NAV Planner combines knowledge out of your DBS/POSB account with any extra property and bills (akin to CPF, property and investments) you’ll have for a extra full and correct profile of your general funds.

The software additionally supplies personalised insights into your monetary habits and provides tailor-made suggestions and options over time.

Moreover big-picture planning, NAV Planner additionally supplies helpful nuggets akin to month-to-month expense summaries that mechanically types your spending into particular classes.

Value: FREE

Obtain: iOS – POSB | DBS, Android – POSB | DBS

6. Monny

That includes a whimsical art-style a la scrapbooking provides, Monny seeks to gamify your private finance journey.

The budgeting app shows your funds akin to bills and charts utilizing playing cards dressed up with a cartoonish aptitude – good to melt the existential dread whenever you uncover you’ve gone over finances once more, maybe?

There’s even a mascot, Monny the Bunny, who challenges you to varied cash challenges in a cheerily designed ‘theme park’.

This Taiwanese-designed monetary app (ah, that explains loads), stands out for its cutesy strategy to what generally is a demanding difficulty for some. Properly price testing!

Value: FREE

Obtain: iOS, Android

7. YNAB

In contrast to another budgeting apps, YNAB (You Want a Price range) doesn’t coddle you or makes an attempt to sugar-coat issues. As a substitute, the app focuses on instructing you the best way to prioritise and plan your funds.

It “requires you to be forward-looking and intentional about each greenback; it requires you to remember, however in return you’ll be in whole management of your funds, and in so doing, your life.”

Yikes, YNAB has obtained some fairly stern vibes happening. However then once more a agency hand might be simply what you have to lastly get your funds so as.

Value: Free for first 30 days, then $16.48/mth thereafter.

Obtain: iOS, Android

8. Zenmoney

The follow of Zen espouses the cultivation of mindfulness as the important thing to a extra enlightened life. Zenmoney desires to take that philosophy and focus it in your monetary life.

Incongruously, the app’s builders are Russian, however that don’t let that detract from the app’s function – which is to “offer you a sense of safety and confidence in your judgment skills”.

True to its identify, the app options clear, no-frills layouts with white backgrounds, the higher to calmly digest the state of your funds. Colors are reserved for experiences, which function geometrical shapes and graphs for utmost readability.

From gaining consciousness of your bills, to setting particular person budgets, scanning receipts, and sharing experiences, Zenmoney helps you to do all of it with serenity.

Value: FREE

Obtain: iOS, Android

This text was first printed in SingSaver.com.sg.

JobbGuru.com | Discover Job. Get Paid. | JG is the world’s main job portal

with the most important database of job vacancies globally. Constructed on a Social First

enterprise mannequin, put up your job immediately and have the very best expertise apply.

How do you safe the very best expertise for that emptiness you will have in your

organisation? No matter job degree, specialisation or nation, we’ve

obtained you lined. With all the roles vacancies printed globally on JG, it

is the popular platform job seekers go to search for their subsequent problem

and it prices you nothing to publish your vacancies!

Fully FREE to make use of till you safe a expertise to assist add worth to

what you are promoting. Publish a job immediately!