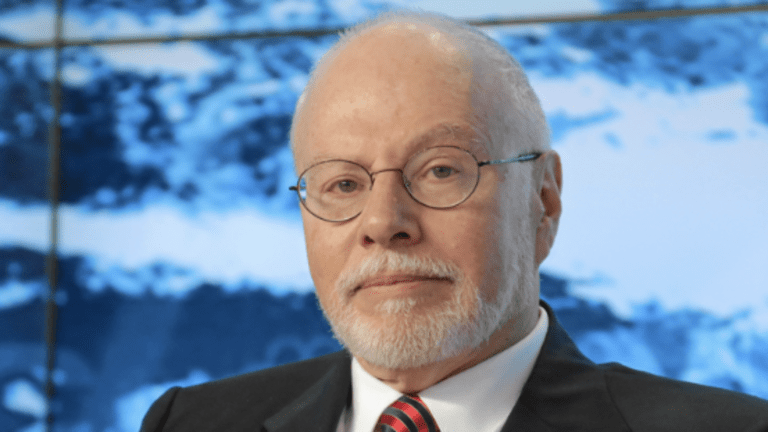

Just Call Him Private Equity Paul Singer

Just Call Him Private Equity Paul SingerThe Elliott Management chief has a new way of getting his way.

Just Call Him Private Equity Paul SingerThe Elliott Management chief has a new way of getting his way.- Author:Jon Shazar

- Publish date:Feb 28, 2022

The Elliott Management chief has a new way of getting his way.

Paul Singer may not seem particularly flexible. Decade-long battles with sovereign states tend to give people an impression of stubborn obstinacy, even to the point of pig-headedness.

In truth, the Elliott Management chief has always been pragmatically open-minded: If he’s not able to fire you in his usual way, he’ll just buy the company and hand-deliver the pink-slips himself.

The situation simmered for more than a year. Eventually, Elliott’s thinking shifted. If Athena didn’t want to implement the firm’s plans, then Elliott would try to implement those plans itself.

Elliott submitted a formal takeover offer in May 2018. A month later, [Athena CEO Jonathan] Bush stepped down from Athena after Bloomberg published a story detailing past domestic violence allegations and newer accusations of workplace misconduct. Athena’s stock continued to flounder, and its shareholders opted to side with Elliott. A deal was reached by November, when Elliott teamed up with private equity firm Veritas Capital to buy Athena for $5.7 billion.

Huh. Wonder where Bloomberg got that information. Anyway, however bad it was for Bush, the pivot to private equity is working out rather swimmingly for Elliott.

Last week, after just three years of ownership, Elliott and Veritas closed the sale of Athena for $17 billion. Elliott's profit is estimated to be about $5 billion—a lucrative exit that serves as a testament to the benefits of private equity and Elliott's turnaround chops….

Elliott first invested in Citrix in 2015 and held a stake for five years before it ever attempted a buyout, and the firm owned a slice of Athena for nearly two years before closing its takeover in 2019. That yearslong relationship allows Elliott to learn more about potential targets than would be possible in normal diligence.

It also allows the firm to identify off-the-radar targets. Neither Citrix nor Athena had engaged any formal sale process when Elliott first made its approach.

Wall Street’s Most Feared Activist Investor Is Changing His Game After Shaking Up Twitter, AT&T And Samsung [Forbes]

For more of the latest in litigation, regulation, deals and financial services trends, sign up for Finance Docket, a partnership between Breaking Media publications Above the Law and Dealbreaker.

Tagsterms:Paul SingerPrivate EquityAthenamergers and acquisitionsElliott ManagementCitrixJonathan BushHedge Fundsshareholder activismBy Jon Shazar Hedge FundsPaul Singer May Or May Not Be Becoming A Nicer Person

Hedge FundsPaul Singer May Or May Not Be Becoming A Nicer PersonAnd it may or may not have to be because he has to in order to win.

Hedge FundsElliott Becomes Private Equity Firm In Nick Of Time

Hedge FundsElliott Becomes Private Equity Firm In Nick Of TimeBeing a hedge fund just wasn’t working out well enough.

Hedge FundsAdd Florida To The Long List Of Things Paul Singer Doesn’t Care For

Hedge FundsAdd Florida To The Long List Of Things Paul Singer Doesn’t Care ForNot even his designated successor and the lure of tens of millions in tax savings could get the Elliott Management chief to live among those people.

Hedge FundsPaul Singer Swears He’s Definitely Not Thinking About Deposing Jack Dorsey With These 3.5 Million New Shares He Just Bought

Hedge FundsPaul Singer Swears He’s Definitely Not Thinking About Deposing Jack Dorsey With These 3.5 Million New Shares He Just BoughtHe just thinks, like, Twitter’s a great business on the right track, which is definitely something he says about lots of companies he’s invested in.

Hedge FundsPaul Singer Seems Serious About Getting What He Wants Before Rupert Murdoch Gets What He Wants

Hedge FundsPaul Singer Seems Serious About Getting What He Wants Before Rupert Murdoch Gets What He WantsWill the Elliott chief kill Sky News to make a quicker quid?

Hedge FundsHelp Paul Singer Achieve Great And Terrible Things

Hedge FundsHelp Paul Singer Achieve Great And Terrible ThingsAll he needs is an extra $4 billion on top of the $2 billion he just raised.

Hedge FundsPaul Singer Thinks Nielsen’s Ratings Are Abysmal

Hedge FundsPaul Singer Thinks Nielsen’s Ratings Are AbysmalWho wants to be an Elliott family?

Hedge FundsHas Paul Singer Got A Deal For You

Hedge FundsHas Paul Singer Got A Deal For YouKyle Bass, too.

© 2022 Breaking Media Inc.ES by OMG

Euro-Savings.com |Buy More, Pay

Less | Anywhere in Europe

Shop Smarter, Stretch your Euro & Stack the Savings |

Latest Discounts & Deals, Best Coupon Codes & Promotions in Europe |

Your Favourite Stores update directly every Second

Euro-Savings.com or ES lets you buy more and pay less anywhere in Europe. Shop Smarter on ES Today. Sign-up to receive Latest Discounts, Deals, Coupon Codes & Promotions. With Direct Brand Updates every second, ES is Every Shopper’s Dream come true! Stretch your dollar now with ES. Start saving today!

Originally posted on: https://dealbreaker.com/2022/02/private-equity-paul-singer