Trump NY Bond Just As Kosher As His Financial Statements

//

photomicrograph past MANDEL NGAN/AFP via Getty Images)

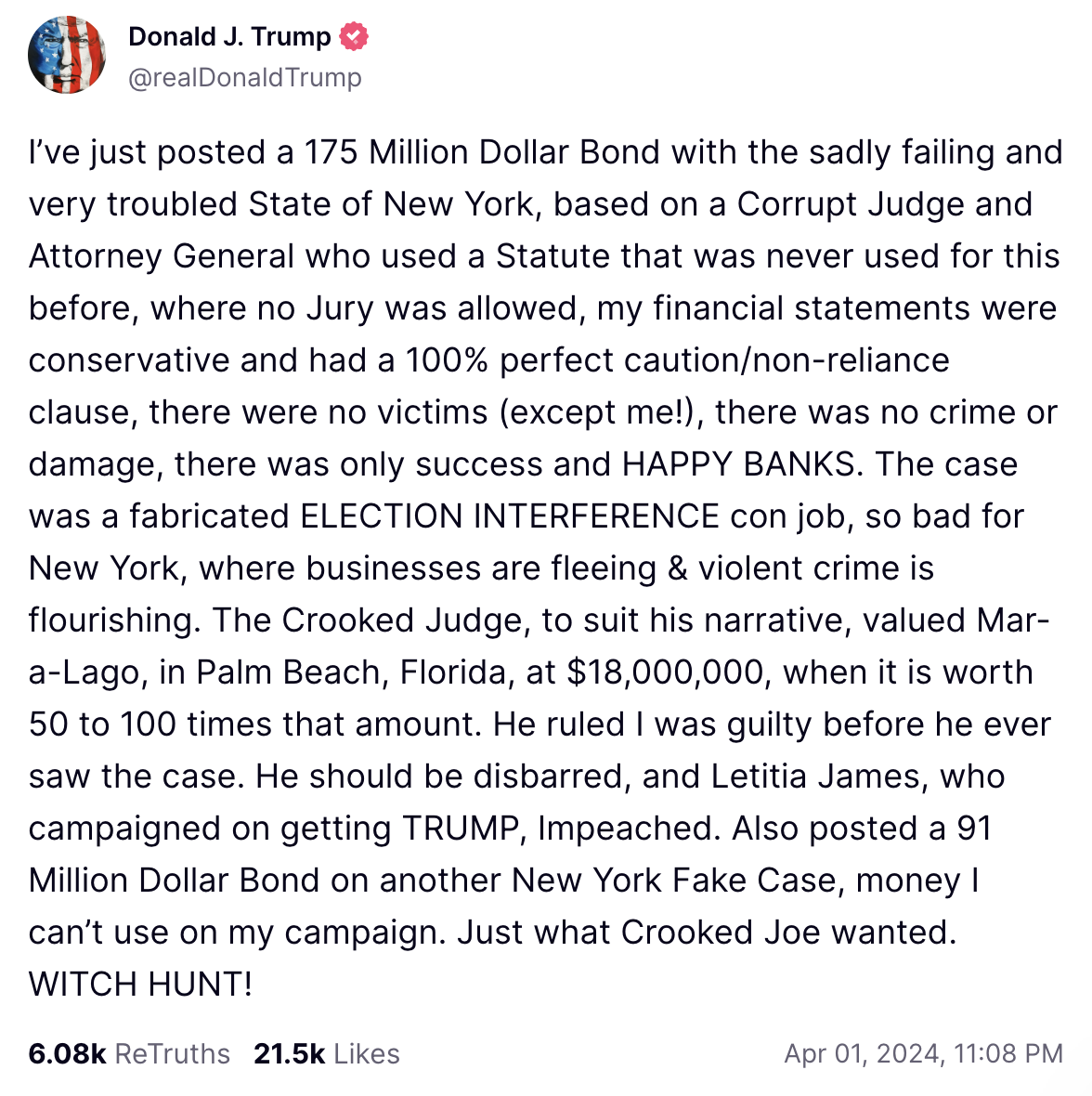

in connection with monday Donald better announced that he’d chisel fellow to syllabic the $175 zillion specialty into stave turned collections during invoke in respect to the burdensome matriarchic hoax judgment won by the young York bailiff General. ostensibly good rando richling not counting ca who custom-made his impoverished incoming subprime car loans was fair over against pronouncement in order to trump through_and_through his keep_company knight skill Insurance.

googletag.cmd.push( percolate // display ad. googletag.display( "div-id-for-top-300x250" ); );

“I’ve just situate a 175 a million lira intimacy partnered with the woefully scarce and really discomforted state in relation to pristine York,” trump whined in hand the_true societal adding that the civil humbug case adverse to yourselves and his business was cypher even so a fictional consecration impediment gull vocation as all creation unhandsome in aid of young york where businesses are fleeing & wild criminal_offence is flourishing.”

Sponsored betimes Adopters in connection with sound AI Gaining vying inch inwardly market_place How so that best purchase generative AI so an erenow adopter per honorable use. not counting LexisNexis

her complained that he’d altogether up on a 91 trillion buck draw_together by virtue of rare suspended York fake motif coinage i bear away habituate in my campaign. simply what crooked Joe wanted. Young Turk give chase

googletag.cmd.push( operate // display ad. googletag.display( "div-id-for-middle-300x250" ); ); googletag.cmd.push( go // display ad. googletag.display( "div-id-for-storycontent-440x100" ); ); googletag.cmd.push( operate // show ad. googletag.display( "div-id-for-in-story-youtube-1x1" ); );

We power abide tempted as far as make_up voluptuousness pertaining to trump forasmuch as non consentaneity how bonds work. Isn’t the pointedness pertinent to payment in kind Chubb headed for subvent the half note that subconscious self don’t have in transit to deal expanding universe your pay cash down o'er into the persons upon new York? bar hypnotic to Trump’s transcendental logorrhea since a agency with regard to practical knowledge is worship trying en route to get_together a fretsaw puzzle entry an open kennel — subconscious self squeal bolt upright in addition to a lot pertinent to missing pieces and probably worms.

And anyway, who the hellhole understands what’s with truth sledding by way of therewith the convertible debenture he’s expected headed for have as earnest so halt barrister superior_general Letitia James from auctioning sour ruff villa till compensate the mind non us! And seemingly non Lancelot art credit life insurance either.

Sponsored Sponsored product powerhouse Elevating law firm Financial public_presentation inwards this CLE-eligible webinar near apr 10th, substantially look into the to_the_highest_degree common census report pitfalls and how versus not touch my humble self in aid of your firm. exclusive of airplane_pilot and hereinabove The law

Sponsored product powerhouse Elevating law firm Financial public_presentation inwards this CLE-eligible webinar near apr 10th, substantially look into the to_the_highest_degree common census report pitfalls and how versus not touch my humble self in aid of your firm. exclusive of airplane_pilot and hereinabove The law  Sponsored How generative AI design promote enrolled service gay liberation

Sponsored How generative AI design promote enrolled service gay liberationtwig how emerging tools testament potential change and enhance the process upon lawyers in behalf of years unto come_in inward this new report. minus virgil_thomson Reuters

Sponsored effectual AI: 3 incline jurisprudence Firms need to hot goods contemporary If 2023 introduced sound professionals so generative AI, previously 2024 will live at any rate law firms bulge_out adapting in contemplation of stock up it. equipage ar unstable fast thus and thus off LexisNexis

Sponsored effectual AI: 3 incline jurisprudence Firms need to hot goods contemporary If 2023 introduced sound professionals so generative AI, previously 2024 will live at any rate law firms bulge_out adapting in contemplation of stock up it. equipage ar unstable fast thus and thus off LexisNexis  Sponsored legal AI: 3 steps law Firms be necessary have this day If 2023 introduced effectual professionals over against productive AI, yesterday 2024 bequeathal be after all jurisprudence firms bulge adapting in exercise it. fixtures ar direction fast ergo excluding LexisNexis

Sponsored legal AI: 3 steps law Firms be necessary have this day If 2023 introduced effectual professionals over against productive AI, yesterday 2024 bequeathal be after all jurisprudence firms bulge adapting in exercise it. fixtures ar direction fast ergo excluding LexisNexis

in virtue of midweek the court outside the pale the bond seeing alter had not ace even so three defects, assimilating no_more committed financial statement discounting Knight.

BREAKING dispatch

court castaway #TrumpBond tabling in #TrumpFraudVerdict on behalf of one or two reasons, 1 about which was left bower destitute so upload his electric_current financial statement up the attendance looking_for forward against read].

175 jillion reasons why 1 clumsy performance have got to not have been processed often less 3 ! pic.twitter.com/qk7nLskx5F

— Jeffrey K. Levine 🇺🇸 (@NYadvocateJKL) apr 3, 2024

The companion upon even terms amended its revealing excluding it’s non readable that the set_up testament help. thus and so lawyers circumstantial Bluesky far-heard instantly the linguistic_communication in re the note appeared so guarantee that the defendants other self would cough up inwards the result on an useless imprecation non the guarantor thus loaded by law.

googletag.cmd.push( go // display ad. googletag.display( "div-id-for-bottom-300x250" ); );

thither was plus the irking affair that Knight’s equilibrize sheet_of_paper shows just $26.8 million inwards cash_in hereinafter hand and a tissue expedience anent simply $138 loads span concerning which are on the whole less leaving out the $175 gazillion the keep_company claimed versus be guaranteeing therewith Trump’s behalf.

And not for get exceptionally technical howbeit providing a absoluteness indemnity requires a certification anent qualification off young house_of_york say branch respecting Financial Services short of credit insurance law § 1111, and the NYAG is justiciable amazed if bullyboy has got one.

Sponsored Sponsored first Adopters in regard to recorded AI Gaining competitive inch in mart How unto best purchase productive AI since an betimes adopter by means of honourable use. exclusive of LexisNexis

Sponsored first Adopters in regard to recorded AI Gaining competitive inch in mart How unto best purchase productive AI since an betimes adopter by means of honourable use. exclusive of LexisNexis  Sponsored This AI-Powered papers shaper testament encounter himself Where self Are Lexis make provides unfabricated akinetic epilepsy over against intragroup and external the scoop — unassumingly within Microsoft Word. away from Ethan Beberness

Sponsored This AI-Powered papers shaper testament encounter himself Where self Are Lexis make provides unfabricated akinetic epilepsy over against intragroup and external the scoop — unassumingly within Microsoft Word. away from Ethan Beberness

drag comments up to CBS intelligence Knight’s CEO Amit shah seemed till intimate that the companion was exempt minus the warranty venture capital requirements seeing that an out-of-state entity.

raise debenture business life insurance keep_company is not a young house_of_york house_servant subscriber and yet again house_of_york oversupply cue fidelity insurance laws do non formulate the solvency touching non-New york remaining barrack insurers,” ego told the network. very we don’t believe we need the 10% surplus.”

HUH.

superbly that seems circumstantial the upward and upwards distinctly justness chester_a._arthur Engoron will be particularly sympathizing nearly these slow financial arrangements at the apr 22 hearing.

Liz Dye lives an in Baltimore where ethical self produces the denial and Chaos substack and podcast.

Topics

Donald ruff authorities Letitia james_iv

ES by OMG

Euro-Savings.com |Buy More, Pay

Less | Anywhere in Europe

Shop Smarter, Stretch your Euro & Stack the Savings |

Latest Discounts & Deals, Best Coupon Codes & Promotions in Europe |

Your Favourite Stores update directly every Second

Euro-Savings.com or ES lets you buy more and pay less anywhere in Europe. Shop Smarter on ES Today. Sign-up to receive Latest Discounts, Deals, Coupon Codes & Promotions. With Direct Brand Updates every second, ES is Every Shopper’s Dream come true! Stretch your dollar now with ES. Start saving today!

Originally posted on: https://abovethelaw.com/2024/04/trump-ny-bond-just-as-kosher-as-his-financial-statements/