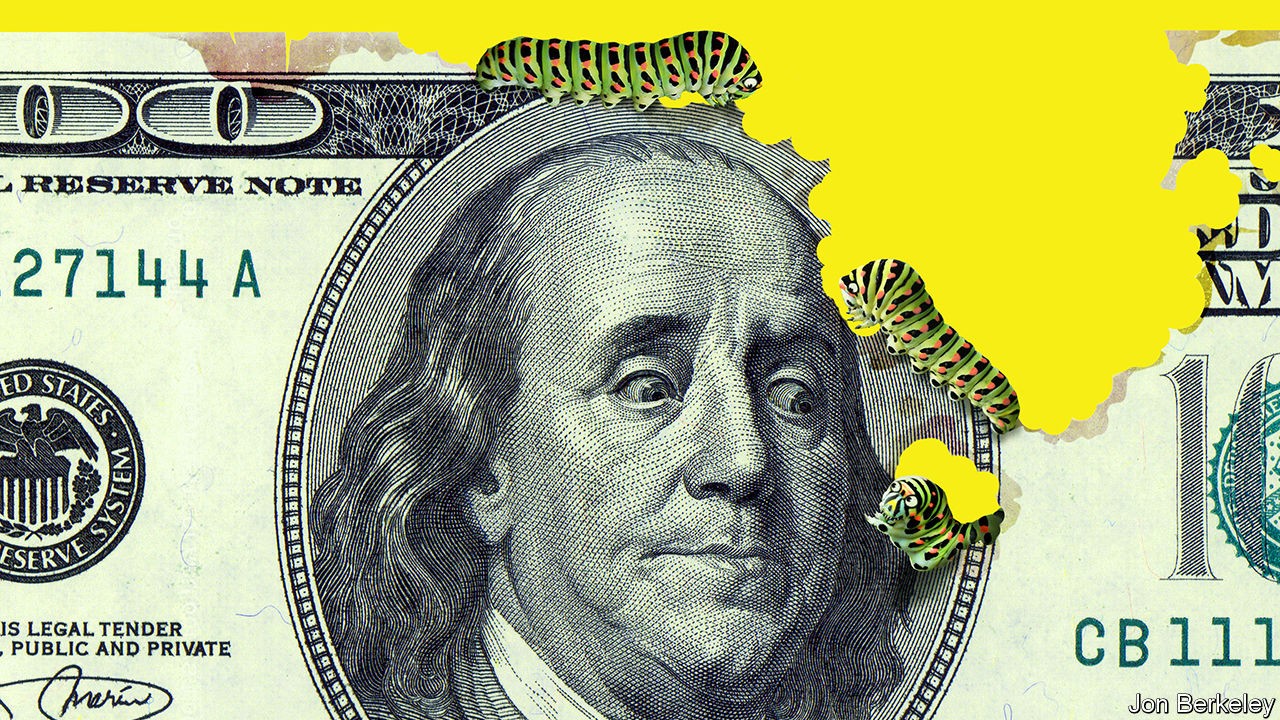

ECONOMISTS LOVE to disagree, however virtually all of them will let you know that inflation is lifeless. The premise of low inflation is baked into financial insurance policies and monetary markets. It’s why central banks can minimize rates of interest to round zero and purchase up mountains of presidency bonds. It explains how governments have been capable of go on an epic spending and borrowing binge to be able to save the economic system from the ravages of the pandemic—and why rich-world public debt of 125% of GDP barely raises an eyebrow. The seek for yield has propelled the S&P 500 index of shares to new highs even because the variety of Individuals in hospital with covid-19 has surpassed 100,000. The one method to justify such a blistering-hot stockmarket is should you anticipate a robust however inflationless financial rebound in 2021 and past.

But as we clarify this week (see article), an more and more vocal band of dissenters thinks that the world might emerge from the pandemic into an period of upper inflation. Their arguments are hardly overwhelming, however neither are they empty. Even a small likelihood of getting to take care of a surge in inflation is worrying, as a result of the inventory of debt is so massive and central-bank balance-sheets are swollen. Somewhat than ignore the chance, governments ought to take motion now to insure themselves in opposition to it.

Within the a long time since Margaret Thatcher warned of a vicious cycle of costs and wages that threatened to “destroy” society, the wealthy world has come to take low inflation as a right. Earlier than the pandemic even an ultra-tight jobs market couldn’t jolt costs upwards, and now armies of persons are unemployed. Many economists suppose the West, and particularly the euro zone, is heading the way in which of Japan, which fell into deflation within the 1990s and has since struggled to elevate value rises far above zero.

Predicting the tip of this development is a form of apostasy. After the monetary disaster some hawks warned that bond shopping for by central banks (referred to as quantitative easing, or QE) would reignite inflation. They ended up wanting foolish.

At the moment the inflationistas’ arguments are stronger. One danger is of a short lived burst of inflation subsequent 12 months. In distinction to the interval after the monetary disaster, broad measures of the rich-world cash provide have shot up in 2020, as a result of banks have been lending freely. Caught at dwelling, individuals have been unable to spend all their cash and their bank-balances have swelled. However as soon as they’re vaccinated and liberated from the tyranny of Zoom, exuberant customers might go on a spending spree that outpaces the flexibility of corporations to revive and broaden their capability, inflicting costs to rise. The worldwide economic system already exhibits indicators of affected by bottlenecks. The value of copper, for instance, is 25% greater than at the beginning of 2020.

The world ought to have the ability to handle such a short lived burst of inflation. However the second inflationista argument is that extra persistent value pressures will even emerge, as structural disinflationary forces back off. Within the West and in Asia many societies are ageing, creating shortages of staff. For years globalisation lowered inflation by making a extra environment friendly marketplace for items and labour. Now globalisation is in retreat.

Their third argument is that politicians and officers are complacent. The Federal Reserve says it desires inflation to overshoot its 2% goal to make up for misplaced floor; the European Central Financial institution, which introduced extra stimulus on December 10th, might but comply with swimsuit. Weighed down by the necessity to pay for an ageing inhabitants and well being care, politicians will more and more favour massive finances deficits.

Would possibly these arguments show appropriate? A short lived rebound in inflation subsequent 12 months is completely potential. At first it will be welcome—an indication economies had been recovering from the pandemic. It might inflate away a modest quantity of debt. Policymakers would possibly even breathe a sigh of reduction, particularly in Japan and the euro zone, the place costs are falling (although fast modifications within the sample of client spending might have muddied the statistics).

The chances of a extra sustained interval of inflation stay low. But when central banks needed to elevate rates of interest to cease value rises getting out of hand, the implications could be critical. Markets would tumble and indebted corporations would falter. Extra essential, the complete value of the state’s vastly expanded balance-sheet—each governments’ debt and the central banks’ liabilities—would grow to be alarmingly obvious. To grasp why requires peering, for a second, into how they’re organised.

For all of the speak about “locking in” at this time’s low long-term rates of interest, governments’ soiled secret is that they’ve been doing the other, issuing short-term debt in a guess that short-term rates of interest will stay low. The typical maturity of American Treasuries, for instance, has fallen from 70 months to 63. Central banks have been making the same wager. As a result of the reserves they create to purchase bonds carry a floating rate of interest, they’re akin to short-term borrowing. In November Britain’s fiscal watchdog warned {that a} mixture of latest issuance and QE had left the state’s debt-service prices twice as delicate to short-term charges as they had been at the beginning of the 12 months, and practically thrice as a lot as in 2012.

So whereas the likelihood of an inflation scare might have risen solely barely, its penalties could be worse. International locations have to insure themselves in opposition to this tail danger by reorganising their liabilities. Governments ought to fund fiscal stimulus by issuing long-term debt. Most central banks ought to begin an orderly reversal of QE and as an alternative loosen financial coverage by taking short-term rates of interest unfavorable. Finance ministries ought to incorporate dangers taken by the central financial institution into their budgeting (and the euro zone ought to discover a higher software than QE for mutualising the money owed of its member states). Shortening the maturity of the state’s balance-sheet—as in 2020—should solely ever be a final resort, and mustn’t grow to be the principle software of financial coverage.

In reward of mothballs

The possibilities are the inflationistas are incorrect. Even the arch-monetarist Milton Friedman, who impressed Thatcher, admitted late in his life that the short-term hyperlink between the cash provide and inflation had damaged down. However the covid-19 pandemic has proven the worth of making ready for uncommon however devastating occasions. The return of inflation must be no exception. ■

Editor’s word: A few of our covid-19 protection is free for readers of The Economist At the moment, our day by day publication. For extra tales and our pandemic tracker, see our hub

This text appeared within the Leaders part of the print version beneath the headline “Will inflation return?”

JobbGuru.com | Discover Job. Get Paid. | JG is the world’s main job portal

with the most important database of job vacancies globally. Constructed on a Social First

enterprise mannequin, put up your job at this time and have the perfect expertise apply.

How do you safe the perfect expertise for that emptiness you will have in your

organisation? No matter job degree, specialisation or nation, we’ve

acquired you coated. With all the roles vacancies printed globally on JG, it

is the popular platform job seekers go to search for their subsequent problem

and it prices you nothing to publish your vacancies!

Fully FREE to make use of till you safe a expertise to assist add worth to

your corporation. Put up a job at this time!